SAMSUNG EXECS BUYING SILVER BELT LAND

Silver demand consistently outpacing supply.

Disclaimer

I personally do not advocate any process or procedure contained in any of my Blogs. Information presented here is not intended to provide legal or lawful advice, nor medical advice, diagnosis, treatment, cure, or prevent any disease. Views expressed are for educational purposes only.

I surround, protect, purify and make harmless the following in-formation.

The Mechanics of Silver Price Suppression

Jesse Colombo

Mar 19, 2025

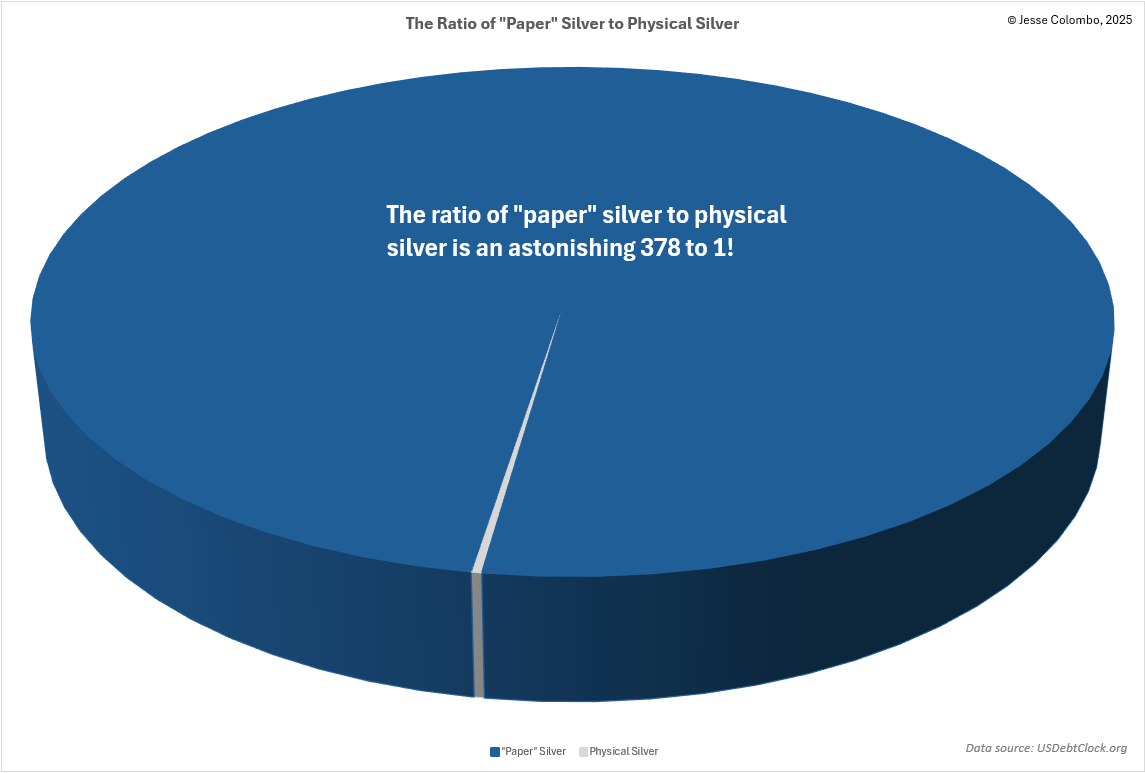

Many precious metals investors have heard about silver manipulation or suspected it, but few fully understand how it works or can clearly explain it. Many also intuitively sense that silver’s price is artificially low and should be much higher but struggle to identify what—or who—is keeping it suppressed. I committed myself to studying silver price manipulation, documenting the evidence, educating others, and exposing these practices to bring them to an end and ensure justice is served. In this article, I explain in clear and accessible terms how silver’s price is systematically manipulated and suppressed.

Simply put, the goal of silver price manipulation is to keep silver’s price artificially low as well as prevent it from breaking above key technical levels that could trigger a full-blown bull market. According to consensus within the precious metals community, the primary culprits behind silver price manipulation are the bullion banks—the most influential players in the precious metals market. These include major financial institutions such as JPMorgan Chase, UBS, HSBC, and Goldman Sachs, several of which have been found guilty of manipulating precious metals markets—particularly gold and silver.

Bullion banks are typically members of the London Bullion Market Association (LBMA), the leading authority overseeing the global over-the-counter (OTC) precious metals market. As LBMA members, these banks play a central role in the market by acting as market makers, facilitating large trades, managing vaulting and storage, and participating in price-setting mechanisms such as the daily London Gold and Silver Fix. This dominant position allows them to exert significant influence over silver prices, making manipulation not just possible, but systemic.

TAMPS

The most common, obvious, and widespread form of silver manipulation is price slams—also known as “tamps”—which almost exclusively take place during the New York COMEX trading session between 8:30 and 11 AM EST. As I’ll explain in greater detail shortly, these slams occur on a high percentage of mornings, but they become even more frequent and aggressive when silver is attempting to break above a key technical or psychological level.

When silver approaches a breakout point that could trigger a snowball effect of additional buying, bullion banks step in to drop the hammer, forcefully slamming the price back down below that level. This calculated suppression is designed to demoralize existing silver investors, discourage new participants, and ensure that silver’s price languishes, preventing momentum from building in its favor.

Root cause of suppressing silver

What motivates bullion banks to suppress the price of silver? They do so on behalf of central banks, such as the Federal Reserve, which seek to maintain confidence in paper currencies like the U.S. dollar. A soaring silver price signals weakness in fiat money, raising doubts about its strength and stability. By keeping silver artificially low, bullion banks help preserve the illusion of a strong dollar.

While the supply of dollars surged and continues to expand, silver has consistently preserved its purchasing power. The compelling chart below illustrates how the purchasing power of $1,000 in silver ounces changed over time. In 1960, $1,000 could buy 1,087 ounces of silver, today, it purchases only 29.74 ounces—a staggering 97% decline in the dollar’s purchasing power relative to silver. This means the same amount of silver in 1960 could buy roughly the same quantity of goods and services then as it does today, whereas the dollar has lost significant value.

Continues at https://thebubblebubble.substack.com/p/the-mechanics-of-silver-price-suppression

Without prejudice and without recourse

Doreen Agostino

Our Greater Destiny Blog

ge&fs

Yes it's interesting how this is all being released at the same time. I watch the AI video last night and you publish information in the morning. No coincidences.

I'm in fact in grateful you backed up what I saw last night.

I watched a YouTube video on the new silver solid state batteries last night.

Silver is going to become unobtainable in the near future from what I am seeing.

The new mini nuclear reactors are also going to consume a huge amount of silver. My cousin is building one in Canada and it is the prototype for many more to come.