Why Bitcoin Exists (and It’s Not to Save You)

Final stretch of the historical reserve currency cycle.

Disclaimer

I personally do not advocate any process or procedure contained in any of my Blogs. Information presented here is not intended to provide legal or lawful advice, nor medical advice, diagnosis, treatment, cure, or prevent any disease. Views expressed are for educational purposes only.

I surround, protect, purify and make harmless the following in-formation.

Bitcoin exists to protect fiat, fiat exists to trap you

By Grey Rabbit Finance

Aug 15, 2025

Together, they guard the only money they can’t confiscate through inflation, regulation, or digital switches: physical gold and silver in your possession.

This isn’t conspiracy; it’s the uncomfortable truth that is slipping through the fingers of the masses.

All global reserve currencies die

History shows they last about 94 years on average before being replaced.

Portugal: ~80 years

Spain: ~110 years

Netherlands: ~80 years

France: ~95 years

Britain: ~105 years

United States: so far, 81 years

The U.S. dollar became the world’s primary reserve currency in 1944 under the Bretton Woods Agreement, when other major currencies pegged to the dollar—and the dollar pegged to Gold. That was 81 years ago. We are now deep into the final stretch of the historical reserve currency cycle.

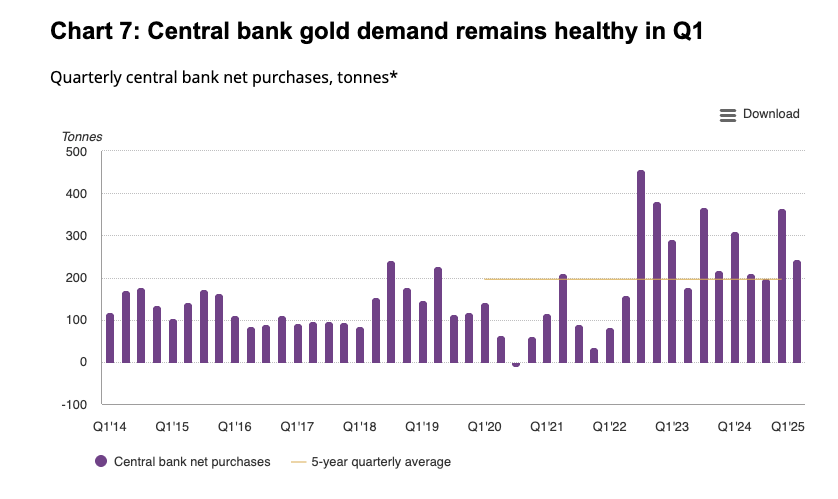

Central Banks Are Not Buying Bitcoin

While the public debates crypto, central banks have been quietly buying gold.

Since 2010: Net buyers of physical gold.

2022: Record 1,100+ tonnes purchased — the most since records began in 1950.

2025: Emerging markets leading the charge.

If Bitcoin were truly “the future of money,” why are the world’s most powerful financial institutions hoarding the oldest form instead?

Because gold and silver remain the only true hedge against fiat collapse — and because they understand Bitcoin’s real purpose, which I’ll expose in the sections ahead.

The Problem They Face… The Solution they Offer.

As trust in the system began to erode after the 2008 financial crisis — and gold and silver kept climbing — central planners faced a serious problem:

How do they keep control over money creation when the public is losing faith?

The fiat regime depends on two pillars:

1. maintaining faith in unbacked currency, and

2. eliminating every viable, tangible alternative.

For decades, they kept precious metals under control through paper market manipulation. Suppressed prices slowed the stampede into gold and silver. But after 2008, cracks began to form, and the dam threatened to burst.

They needed a new decoy

Something the public would believe was even better than gold. Something “shinier.” Something that looked like freedom but kept control in their hands. A distraction to buy the dying monetary system just a little more time.

Enter Bitcoin: The Trojan Horse Liquidity Trap

I’ve called Bitcoin and cryptocurrency a trojan horse/liquidity trap for years. That’s exactly what it is, a pressure valve to keep capital inside the digital corral of the West’s legacy financial system.

Instead of Citizens fleeing to gold and silver—decentralized money you can hold in your hand—the public is enticed into a “new” asset that exists entirely in cyberspace. Lured by over pumped-up gains.

There, it can be tracked, regulated, taxed and—if necessary—frozen or censored. With the Fiat on and off ramps controlled, holders of this new asset class are at the mercy of the legacy system.

To seal the psychological link, its logo glitters like the very metal it seeks to replace

Bitcoin offers the appearance of an independent inflationary hedge, while keeping users tethered to a controlled, surveilled environment.

How the Rug Pull Plays Out

Continues at

https://greyrabbitfinance.substack.com/p/why-bitcoin-exists-and-its-not-to

A time of great transition and recalibration

Without prejudice and without recourse

Doreen Agostino

Our Greater Destiny Blog

gf&es

Thank you. Agreed. It was a psyop all along......many not ready to admit yet that they were fooled.

Just another Bubble that's going to pop. They certainly have doing everything to destroy Western Civilization.